Hey there, fellow PE enthusiasts! Today, let’s dive into the exciting and somewhat secretive world of private equity fundraising. It’s the lifeblood of these fund managers, enabling them to secure the capital needed to invest in promising businesses and make some serious returns. However, despite its importance, partners in private equity firms often have a love-hate relationship with fundraising. Let’s uncover why!

Importance of Fundraising

Fundraising is the fuel that powers private equity fund managers’ operations. Without it, their investment strategies would remain mere concepts on paper. With millions, or even billions, of dollars at stake, fundraising allows fund managers to participate in high-value transactions, acquire businesses, and support portfolio company growth. It’s the key to turning potential investments into tangible opportunities.

Dreaded Challenges for Partners

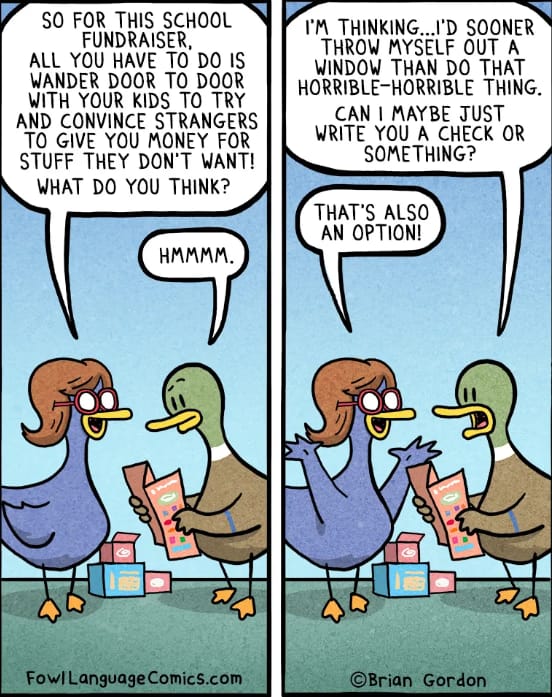

Now, let’s get to the heart of the matter. Partners in private equity firms sometimes cringe at the thought of fundraising. Why? Well, for starters, it demands tremendous time and effort. Partners are typically laser-focused on generating lucrative investment opportunities and overseeing existing portfolio companies. Diverting their attention to fundraising can be daunting, as it requires extensive due diligence, pitch presentations, and nerve-wracking negotiations.

The Sales and Marketing Stigma

Another reason partners may shy away from fundraising is the sales and marketing aspect. Fundraising demands exceptional interpersonal skills and the ability to effectively communicate the fund’s investment strategy, track record, and potential returns to potential investors. Not all partners are natural-born salespeople, and some may prefer to focus on the analytical and operational aspects of their roles rather than selling their fund to potential investors.

Navigating the Competitive Landscape

Let’s not forget about the fiercely competitive fundraising landscape. The number of private equity funds is at an all-time high, making it increasingly challenging to secure commitments from investors. The pressure to consistently meet fundraising targets and maintain relationships with existing investors can be overwhelming for partners. It’s a high-stakes game that demands persistence, adaptability, and an unwavering belief in the fund’s value proposition.

Fundraising in 2023

According to an FT article, private equity funds raised $347bn globally in 2022, down 16% from $413bn the previous year and 5% below the average of the past five years. Fundraising in Q1, 2023 was down further, especially in the Venture Capital, where funds raised dropped 38% year-on-year. Fundraising is not for the faint-hearted!

Conclusion

Fundraising is undeniably vital for private equity fund managers. It provides the capital needed to turn investment strategies into reality, diversify investor bases, and build a stellar track record. However, partners in these firms often grapple with the challenges fundraising presents.

The time-consuming nature, the need for sales and marketing prowess, and the intensifying competition can create a love-hate relationship with this crucial activity. Nevertheless, recognizing the significance of fundraising and finding ways to navigate these challenges is essential for private equity firms’ long-term success and growth.

So, there you have it, a glimpse into the intriguing world of private equity fundraising and the delicate balance partners must strike. Want to start your own private equity firm? Build a track record and master fundraising. 🙂