Guides

Your insider guide to private equity

The courtship / initial due diligence

Once you have determined that a private equity firm is credible and a good fit for your business, you enter the courtship phase, during which they get to know your business and see the team better.

This process, known as initial/desktop due diligence, can be unsettling. You will be asked probing questions about your business and pricing model, top customers and suppliers, key staff members, financial records, near-term plans, etc. In the words of an entrepreneur from Kedah, this feels like playing poker with all your cards face up.

Non-disclosure agreement

The first point to consider is confidentiality and signing a non-disclosure agreement (NDA). If the private equity firm has investments in competitors in your industry, be extra careful when revealing information. You may want to withhold sensitive information until a term sheet is on the table.

Timing and resources

The second point to consider is the practical issue of timing and resources. How long does your team need to prepare the necessary information and documents? Who do you want to be involved in this process? You may want to commence desktop due diligence when your team is not busy with other priorities. Common considerations include peak sales season, the closing of the financial year end, or dealing with auditors.

Professional help

Thirdly, should you seek professional advice from a sell-side adviser to help navigate the due diligence process and protect your interests throughout it?

You will have to weigh the costs of hiring one—fees commonly come in two components: a monthly retainer and a success fee tagged to a percentage of the transaction in the event the deal closes—against the size of your business, the amount you are looking to raise, and your team’s capability.

The bigger your business and the amount you want to raise, the more likely you are to benefit from hiring professionals at this stage.

What is considered the ‘market’ for success fees? It usually ranges from 0.5% to 2% and can be as high as 5% for small transactions.

Skeletons in the closet

If your business has sensitive areas such as under-declaration of taxes, non-compliance with licensing requirements, and use of proxies as shareholders, please be upfront and transparent about them.

Seasoned private equity practitioners have seen it all and will likely not be shocked by your revelations, no matter how bad they seem.

There is no point concealing problematic areas of your business, as they will surface during formal due diligence. Share all key potential red flags upfront, and we can decide whether or not to pursue the deal early on, saving valuable time and money for both sides.

Financial projections

The 5-year business plan and financial projections are included in the list of courtship questions (‘How lovely!’).

From my experience, most business owners wear rose-tinted glasses and submit overly upbeat future projections.

Common issues with financial projections

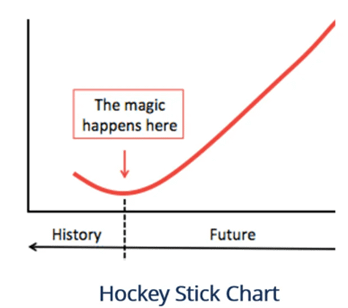

1. Excessive optimism: You project significant revenue and profit growth, frequently with a ‘hockey-stick’ figure that may bear little resemblance to your recent past.

For example, if you run a chain of clinics, you may project opening five new outlets per year, with patients per doctor per day projected to be higher than even your most productive clinic today.

2. Unrealistic timeline: You project new product launches that are developed, marketed and taken up by customers at a record phase, leaving no room for errors at every stage of development.

3. Business model transition: Quite often, we see businesses building in a business model transition over the next 1-2 years, e.g., an OEM perfume manufacturer successfully entering the retail segment and opening 25 outlets within two years.

It is often unclear whether your current team has sufficient management experience and expertise to drive the business model transition. Who will be responsible for hunting and negotiating leases, designing and overseeing store renovations, and overseeing merchandising and marketing?

4 Missing costs and investments: Costs related to developing a new product or transitioning a business model are frequently understated. For example, the working capital and CAPEX requirements to set up a chain of retail outlets (funding the perfume inventory, renovating the outlets, and paying landlords their deposits) may be missing.

Optimistic yet credible

I was once asked how business owners should ‘angle’ their financial projections; the dilemma is that if they are too conservative, private equity firms may offer a low value for their business.

Speaking as a PE practitioner, I recommend that you prepare realistic, thoughtful, and credible financial projections. This immediately puts you ahead of 95% of other businesses we meet and gets you the attention your business deserves.

The private equity analyst will briefly study wildly optimistic financial projections and promptly discard them. If the analyst is still keen to investigate your business, he will build his projections independently based on what he understands your business to be during the courtship process.

What are the common ways in which private equity values my business? You may find out more about how to evaluate a term sheet section.

Understanding the perspective of a PE firm during courtship

Someone wise once commented that chasing private equity deals is like a hungry lion hunting down prey (pardon the unfortunate imagery!).

During a chase, a lion’s heart and breathing rates increase dramatically, and its muscles work hard to capture and subdue the prey. This high-intensity activity can rapidly deplete the lion’s energy stores.

Given the high costs of a hunt, a lion cannot afford too many failed hunts.

Pursuing a private equity deal and conducting initial due diligence is time-consuming. A good investment analyst will aim to walk away from unattractive or low-probability deals as early as possible.

Are they serious?

Thus, you must gauge the interest and seriousness of the private equity firm as you task your inner circle to prepare and share materials on your business. The situation you want to avoid is to spend weeks preparing for the exhaustive list of questions, only for the PE firm to walk away, having made up their minds weeks ago.

Frequent communication = good

Frequent communication and follow-up questions from the analyst are good signs. If in doubt, a discreet call to the analyst or deal partner should clear the air. A quick ‘no’ from the PE investor will save you and your team lots of precious time.

If everything goes smoothly, you will receive an investment term sheet after 2-4 weeks after the courtship period.