Guides

Your insider guide to private equity

How to evaluate a term sheet

I wrote the following based on my own experience. Please note that this does not constitute legal advice.

Tip: Discreetly ask about the private equity firm’s internal approval process before negotiating the term sheet. All investment decisions are usually approved by an investment committee/panel. You want to understand the working dynamics between the deal principal and the investment committee.

A good deal principal maintains close working relationships with all committee members and has a high chance of securing approval for the negotiated term sheet.

Be wary if you hear that most investment committee members are based outside the country or if the working relationship is strained. You may spend hours negotiating the term sheet only to see the investment rejected at the committee level.

Binding vs. non-binding terms

While term sheets are mostly non-binding, it is worth understanding which of the terms are binding:

- Exclusivity – typically 90-120 days.

- Costs – This usually states that the private equity firm has the right to recover its costs should you, having signed the term sheet, subsequently decide to terminate the transaction for reasons unrelated to negotiation. For example, another investor subsequently offers you a better deal, and you choose to terminate the ongoing process.

- Confidentially – nothing diminishes your credibility more than us hearing from a third-party details about our term sheet. This is a small industry, and people talk.

Purchase price

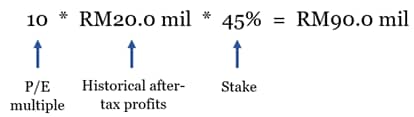

Most businesses are valued by private equity on a profit-multiple basis, either EV/EBITDA or P/E.

The multiple is usually derived from the public market average of businesses like yours, adjusted for your business’s specific qualities (or lack thereof!).

For example, you may receive a premium on multiple should your business growth be higher than average, your brand is the leading one in the country, or you have proprietary technology which reduces your production costs etc. On the other hand, there is a discount on multiple, typically 20-30%, for private companies as your business has not gone through the rigours of an IPO process.

The negotiated valuation multiple often boils down to this: How much do you want to sell/raise capital compared to how keen the private equity firm is to invest?

Earnings are’ normalised’, whether EBITDA or after-tax profits, meaning non-recurring revenues or costs are adjusted out, leaving only maintainable profits. For example, say your latest after-tax profits were RM19.5 mil, and included in this figure is a one-off RM0.5 mil donation to flood victims living near your factory. Your normalised after-tax profits will be RM20.0 mil.

For example, if a private equity firm offered to value your business at 10x after-tax profits and would like to purchase a 45% stake, they would need to pay you RM90.0 mil.

Depending on the time of the year the negotiation is conducted, the earnings may be based on a ‘historical’ or ‘forward’ basis.

Take the example of a deal negotiated in August for your business, which has a December year-end. You may say that while your business made RM20.0 mil in after-tax profits last year, based on its year-to-date performance, you think it will make RM24.0 mil this year.

In this case, you may want to push for a valuation of 10x after-tax profits for the coming year. The private equity firm will now have to pay you RM108.0 mil instead of RM90.0 mil (from the example above). Sweet?

Cash at closing / Earnout

When negotiating a deal, sellers usually ask for the highest price possible, basing the company’s value on tomorrow’s earnings while buyers naturally want the lowest price possible, basing the company’s value on past track record.

Features such as earnouts and rachets (covered below) are used to bridge the valuation gap between the seller (you) and the buyer (us).

You should pay attention to the actual cash you receive at the completion of a deal, which may differ from the headline amount.

It is not uncommon for cash payments to be in tranches, e.g. you receive a certain amount at closing, and then a subsequent variable amount that will be computed on your next audited EBITDA/after-tax profits.

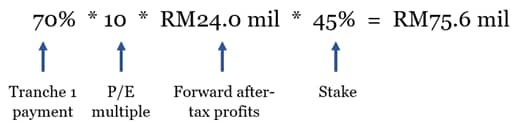

Going back to the above example, a private equity firm may agree to use a forward 10x after-tax profits valuation. However, it will only pay you 70% of the consideration upfront. The balance consideration will be paid upon the issuance of your next audited accounts.

For example, at the end of the year, you realised your original after-tax profits of RM24.0 mil were slightly optimistic and that you ended the year instead with after-tax profits of RM22.0 mil.

You receive immediately at closing RM75.6 mil.

Upon the issuance of your next audited accounts, you receive a further: RM23.4 mil

Thus, you receive a total consideration of RM99.0 mil, instead of the RM108.0 mil initially envisaged.

Rachet

A variation of the earnout mechanism is the rachet.

Unlike the earnout, where the final purchase price is contingent on a forward after-tax profit figure, a rachet fixes the purchase price but varies the % stake purchased from you depending on your business’s future performance.

For example, assume the private equity is offering to pay you RM108.0 mil but has asked for a rachet based on a 10x forward after-tax profits, with a ceiling valuation of RM240.0 mil.

At closing, you will transfer 45.0% of shares to the private equity firm based on the ceiling valuation. At this point, your business’s final valuation has not been determined as you have not received your next audited financial statements.

The issuance of your next audited financial statements will fix the valuation of your company. In the event the after-tax profits come in at RM22.0 mil, instead of the forecasted RM24.0 mil, your business valuation will be set at RM220.0 mil.

Based on this valuation, you will need to transfer 49.1% of your business’s stake to the firm, or an additional 4.1% (49.1% less 45.0%) stake. The additional stake is usually transacted at a nominal price of RM1.

Tip: If the term sheet does not mention a floor valuation, say RM200.0 mil, you may want to negotiate one. With a floor valuation, even if your after-tax profits sink to RM18.0 mil, you will only have to transfer an additional 9.0% stake to the private equity firm.

Funding sources / Certainty of closing

You will want to examine the funding sources of a private equity offer and whether it is readily available and can be fulfilled upon completion of the deal.

I have seen cases where a seller chooses a buyer with no readily available funds because they offered a higher valuation. The deal did not eventually close because the buyer was unable to secure the required capital.

Exit clauses

1. Put option

Put options are usually present when a private equity investor is expected to be a minority shareholder in your company. They are rare in buyout deals.

Put option refers to our right to compel you to purchase our stake at a pre-determined price or price formula upon the occurrence of certain events, usually tied to a future date. You will want to pay attention to i) what are the trigger events which render the right exercisable, ii) the pricing formula and iii) the length of time.

In practice, put options are exercised reluctantly and as a last resort if the PE firm cannot exit its investment within the investment tenure.

Think carefully before accepting a put option. Do I have enough resources to finance my hefty obligations when the private equity firm exercises its put? If the answer is no, why put yourself in a position where you potentially have this obligation? Once the agreement is signed, the investor can bring you to court to enforce the put.

2. Right of first refusal (ROFR)

The right of first refusal is a standard clause that gives shareholders the right to buy the shares of a shareholder who wants to sell them to a third party. The shareholder who wants to sell must first offer their shares to existing investors at the same price and terms negotiated with the third party. Is this fair?

3. Tag along, Co-sale, Drag along rights

Tag-along rights give minority shareholders the right to join a sale by majority shareholders and sell their shares at the same price and terms. This protects them from being left behind with a reduced stake or an unwanted new partner.

In simple English, tag-along means when a big fish sells, a small fish gets to sell, too.

Big Fish Eat Little Fish, 1557, Pieter van der Heyden

Co-sale rights are similar to tag-along rights but apply when a shareholder sells their shares to a third party outside the company. This gives other shareholders the right to participate in the sale and sell their shares proportionally at the same price and terms.

In simple English, co-sale means that if any fish sells, other fish gets to sell, too.

Drag-along rights give majority shareholders the right to force minority shareholders to sell their shares in a sale by majority shareholders. This ensures that minority shareholders do not block or delay a sale that benefits most shareholders. A common mitigation for minority shareholders is to agree on a minimum sale price before the drag-along is exercisable. Why should one be forced to sell on the cheap?

In simple English, drag-along means big fish can force small fish to sell together.

Instruments

Ordinary shares are the primary form of private equity investment. We provide funds to your company in return for the issuance of fresh ordinary shares or buy a portion or all of your ordinary shares from you.

This ownership stake gives us certain rights, such as the right to vote on important company decisions and to share in the company’s profits.

Convertible preferred: Convertible preferred is an investment that allows us to convert our preferred shares into ordinary ones later. Preferred shares are a type of ownership stake that gives us certain rights and preferences over ordinary shareholders, such as a guaranteed dividend payment and a preference in the event of a liquidation or sale of your business.

If we choose to convert our preferred shares into ordinary shares, we will give up these preferences in exchange for the potential for greater returns through ownership of ordinary shares. Convertible preferred equity investments are often used when we want the security of a preferred equity investment but also want the option for potentially more significant returns through conversion to ordinary shares later.

Management & Control rights

Management and control rights can be looked at through the lens of the stake held by the private equity firm:

| Stake held by PE firm | Level of control |

|---|---|

| Controlling stake, anywhere from 51% to 100% | PE firm has free reign in the business, they now ‘drive the bus’. To the extent you still own equity, you are now a passenger on the bus. |

| Larger minority, upwards of 25% | PE firm has board sit and significant negative control rights. |

| Deep minority, typically below 10% | You retain free reign in the business, PE firm is a ‘passenger on the bus’. |

You are now ready to proceed to confirmatory due diligence.